Our purpose is to protect communities and enable prosperity.

Our corporate values and purpose underpin our sustainability strategy, which focuses on core areas where we can apply our business strengths to make a meaningful impact on society.

As a reinsurance company, we support the transition to a more sustainable future by expertly managing risk and volatility, acting as a responsible asset owner, and managing the environmental impact of our business operations.

Our Focus on Sustainability

At RenaissanceRe, we are dedicated to sustainable and responsible business practices, aligning strategies and operations with universal principles on human rights, labor, environment, and anti-corruption as participants in the UN Global Compact and signatories of the UN Principles for Responsible Investment and Sustainable Insurance.

Promoting Climate Resilience

Developing and sharing our skills and expertise to help the world better manage climate risk

Closing the Protection Gap

Partnering to provide sustainable risk mitigation solutions for those who are vulnerable in society As environmental and social risks continue to impact vulnerable communities worldwide, it is crucial for all stakeholders to collaborate in closing the protection gap. By continuing to foster industry partnerships, we believe we can create sustainable solutions to mitigate risks, minimize impacts and strengthen resilience to promote sustainable development for the most vulnerable communities.

Inducing Positive Societal Change

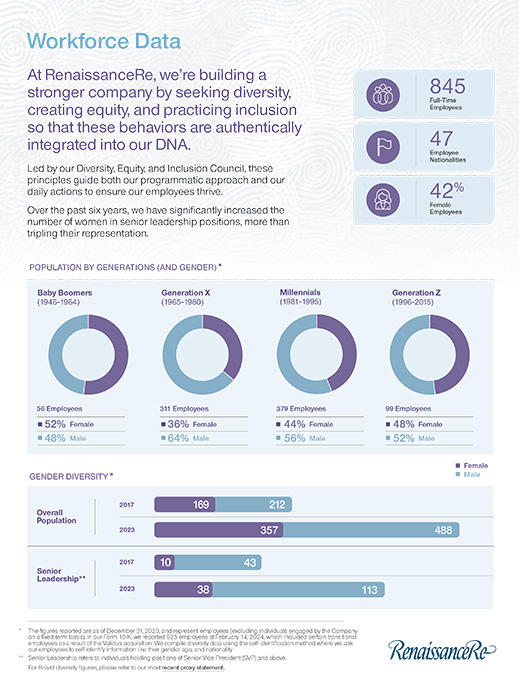

By celebrating what makes each of us unique and embracing our diversity, we believe we are better able to meet tomorrow with open minds, optimism and a spirit of community that welcomes everyone. In recent years we have increased the percentage of women in senior leadership positions, in line with our efforts to seek diversity, create equity and practice inclusion.

Sustainability Highlights

Environmental

Footprint

29%

Estimated reduction in carbon footprint from 2019 to 2023.

Responsible

Investing

72%

Estimated reduction in the carbon intensity of our corporate credit and equity portfolios from December 31, 2020 to December 31, 2024 as measured by MSCI.

People

43%

Female representation in workforce*, as of December 31, 2024.

*We compile diversity data using the self-identification method as we ask our employees to voluntarily self-identify their gender, age and nationality during the onboarding process.

Sustainability Reporting

We drive forward our sustainability strategy through our key focus areas: risk expertise, underwriting approach, investment practices, operations, and partnerships. The following key sustainability disclosures highlight our progress.

Downloads

Disclosure Documents

For more insights into our responsible investing practices, sustainability governance, environmental commitments, climate-related financial disclosure, and other key areas, please take a moment to review our disclosure documents. They reflect our commitment to transparency and accountability, offering valuable information about our operations.

Sustainability and Related Policies

US – Transparency in Coverage Rule

This link leads to the machine-readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.